Important Notice: Fraudulent Schemes Impersonating SystematicaRead More

Our Firm

Employing science and technology to achieve a superior investment approach

Our Values

Guided by values, focused on results

Innovation

Technology continues to reshape the investment landscape - and Systematica has been at the forefront of that transformation for over two decades. From harnessing alternative data to accessing previously untapped markets and advancing electronic trading. We embrace change as a catalyst for opportunity.

Our long-standing investment in proprietary technology and trading infrastructure reflects a deep commitment to innovation. We don’t just adapt to change - we anticipate it. By combining rigorous research with cutting-edge tools, we continuously seek smarter, more creative ways to generate returns and manage risk.

Excellence

The pursuit of excellence is embedded in everything we do at Systematica. As our founder Leda Braga puts it, “I don’t know if we are the best at what we do, but we certainly work hard every day aiming to be just that.”

This mindset drives a culture of continuous improvement, precision, and high performance. It’s reflected not only in our day to day but also in the recognition we’ve earned, with over twenty five industry awards and many more nominations since 2015. For us, excellence is not a destination, but a standard we strive to exceed every day.

Teamwork

Collaboration is at the heart of everything we do at Systematica. We believe that the best ideas emerge when diverse perspectives come together, grounded in mutual respect and a shared commitment to excellence.

Our culture is one of open dialogue, trust, and collective responsibility. We challenge each other, support one another, and celebrate success as a team - because we know that individual brilliance thrives in an environment of strong collaboration.

Teamwork isn’t just how we work - it’s who we are. Across teams, time zones, and disciplines, we win together.

Integrity

We are acutely aware of the responsibility that comes with managing our clients’ capital, and we honour that responsibility with high ethical standards and accountability.

We believe that integrity flourishes in an environment built on transparency and fairness. That’s why we foster a culture where openness is the norm, and where doing the right thing takes precedence.

Our decisions are grounded in principle, not just performance. We hold ourselves to the highest standards because we know that long-term relationships, enduring results, and real impact are only possible when integrity leads the way.

Fun

We believe that a healthy dose of enjoyment enhances performance.

At Systematica, fun isn’t about distraction - it’s about fostering a culture where people feel energised, connected, and able to bring their whole selves to work.

Our Values

Guided by values, focused on results

Innovation

Technology continues to reshape the investment landscape - and Systematica has been at the forefront of that transformation for over two decades. From harnessing alternative data to accessing previously untapped markets and advancing electronic trading. We embrace change as a catalyst for opportunity.

Our long-standing investment in proprietary technology and trading infrastructure reflects a deep commitment to innovation. We don’t just adapt to change - we anticipate it. By combining rigorous research with cutting-edge tools, we continuously seek smarter, more creative ways to generate returns and manage risk.

Excellence

The pursuit of excellence is embedded in everything we do at Systematica. As our founder Leda Braga puts it, “I don’t know if we are the best at what we do, but we certainly work hard every day aiming to be just that.”

This mindset drives a culture of continuous improvement, precision, and high performance. It’s reflected not only in our day to day but also in the recognition we’ve earned, with over twenty five industry awards and many more nominations since 2015. For us, excellence is not a destination, but a standard we strive to exceed every day.

Teamwork

Collaboration is at the heart of everything we do at Systematica. We believe that the best ideas emerge when diverse perspectives come together, grounded in mutual respect and a shared commitment to excellence.

Our culture is one of open dialogue, trust, and collective responsibility. We challenge each other, support one another, and celebrate success as a team - because we know that individual brilliance thrives in an environment of strong collaboration.

Teamwork isn’t just how we work - it’s who we are. Across teams, time zones, and disciplines, we win together.

Integrity

We are acutely aware of the responsibility that comes with managing our clients’ capital, and we honour that responsibility with high ethical standards and accountability.

We believe that integrity flourishes in an environment built on transparency and fairness. That’s why we foster a culture where openness is the norm, and where doing the right thing takes precedence.

Our decisions are grounded in principle, not just performance. We hold ourselves to the highest standards because we know that long-term relationships, enduring results, and real impact are only possible when integrity leads the way.

Fun

We believe that a healthy dose of enjoyment enhances performance.

At Systematica, fun isn’t about distraction - it’s about fostering a culture where people feel energised, connected, and able to bring their whole selves to work.

Our Investment Philosophy

What gets measured, gets managed. As a systematic investment firm, we are guided by data – not emotions.

We are pioneers in data-driven investing, who avoid discretionary intervention with our models. Instead, interactions come through our rigorous research process.

We leverage our deep expertise in OTC and derivatives markets to develop diversified strategies with robust risk controls.

This combination of systematic discipline, market knowledge and innovative data processing capabilities, enables us to address the evolving needs of clients worldwide.

Markets Traded

Trading Coverage Per Day

Orders Executed

(2024)

Strategies

Our History

20+ Years of Track Record

April 2004

BlueTrend Launch

September 2014

Spin-Out Announcement

October 2015

SAM Launch

June 2016

Product Diversification

October 2017

Responsible Commitment

September 2019

SAM Growth

October 2020

Shanghai Office

June 2022

FQ Acquisition

April 2024

SLM Rebrand

October 2001

Quantitative Leader

November 2007

BlueMatrix Launch

January 2015

Systematica Launch

December 2015

BlueTrend UCITS

November 2016

Multi-Fund Launch

June 2018

Growth Milestones

September 2020

SCM Debut

June 2021

AUM Milestones

July 2023

SYMS Launch

Management Team

Leda Braga

Chief Executive Officer

Read More

Ben Dixon

General Counsel, Chief Compliance Officer

Read More

Paul Rouse

Chief Financial Officer

Read More

Matthias Hagmann

Co-Chief Investment Officer

Read More

Jean-Pierre Selvatico

Co-Chief Investment Officer

Read More

Ben Maxmin

Head of Sales and Investor Relations

Read More

Adam Knowles

Chief Operating Officer

Read More

Investment Team

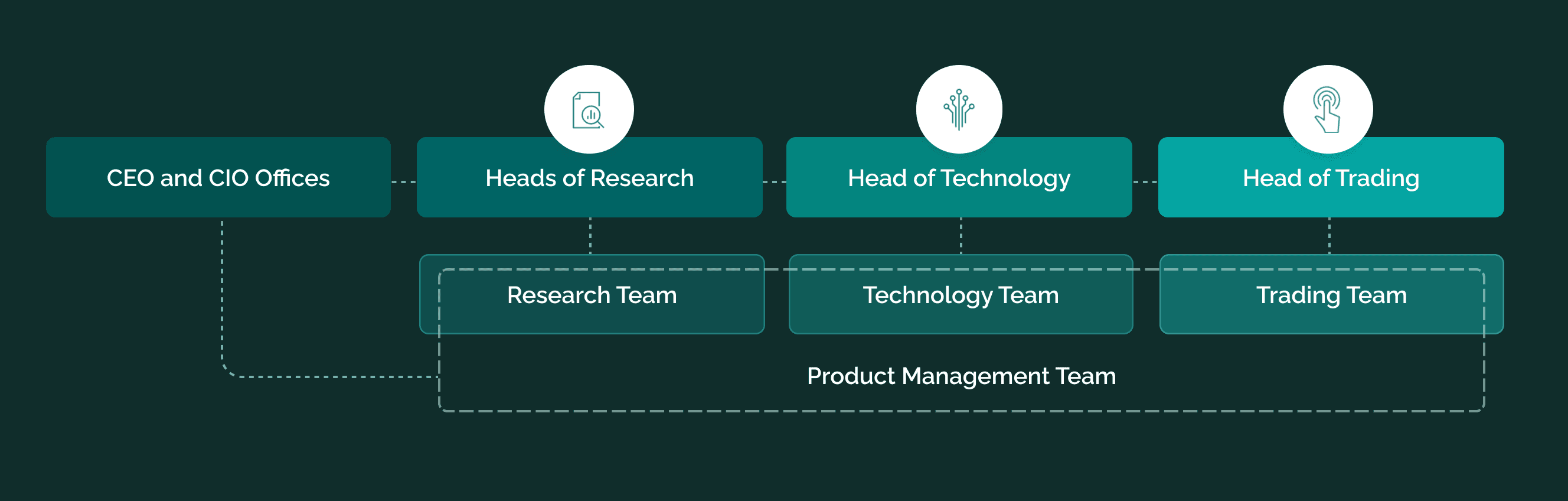

The Investment Team is organised functionally across three lines; Research, Technology and Trading with the Product Management team providing strategic oversight, coordination and development direction.